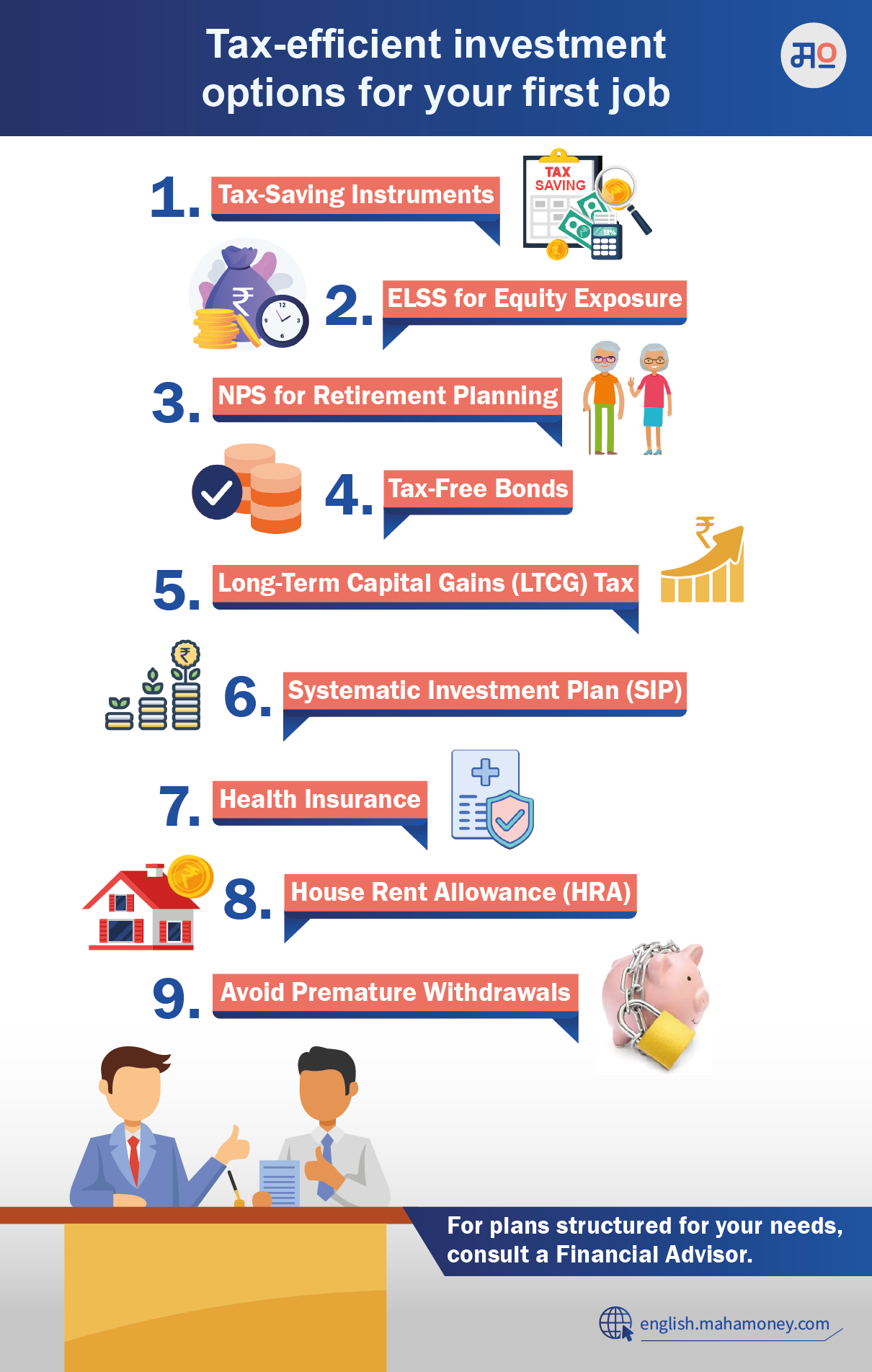

Understanding tax-efficient investment options is crucial for maximizing your earnings as you begin your professional journey. Here are some considerations to help you make wise choices:

Table of contents [Show]

1. Tax-Saving Instruments

Utilize tax-saving investment options like Equity Linked Savings Scheme (ELSS), Public Provident Fund (PPF), and National Pension System (NPS). These provide deductions under Section 80C of the Income Tax Act.

2. ELSS for Equity Exposure

ELSS offers tax benefits and exposure to the equity market. It has a lock-in period of three years, making it an attractive option for young investors with a higher risk appetite.

3. NPS for Retirement Planning

NPS is a tax-efficient retirement savings option. Contributions to NPS qualify for deductions under Section 80CCD(1B) over and above the Section 80C limit.

4. Tax-Free Bonds

Consider investing in tax-free bonds issued by government entities. Interest earned on these bonds is tax-exempt, making them an attractive option for low-risk investors.

5. Long-Term Capital Gains (LTCG) Tax

Be mindful of LTCG tax on equity investments exceeding one lakh rupees. Investments held for over one year are subject to a 10% tax on gains.

6. Systematic Investment Plan (SIP)

SIPs in equity mutual funds can help you benefit from rupee cost averaging and tax-efficient returns over the long term.

7. Health Insurance

Avail health insurance to claim deductions under Section 80D. It safeguards your finances from medical expenses and offers tax benefits.

8. House Rent Allowance (HRA)

If you live in a rented accommodation, you can claim HRA exemptions under Section 10(13A) of the Income Tax Act.

9. Avoid Premature Withdrawals

Premature withdrawals from tax-saving investments like PPF can attract penalties. Stay invested for the prescribed lock-in periods to optimize tax benefits.

10. Consult a Financial Advisor

Tax planning can be complex. Seek guidance from a financial advisor to tailor a tax-efficient investment strategy based on your financial goals.

As you start your first job, being tax-efficient in your investment choices is crucial for optimizing your earnings. Remember, tax planning is an ongoing process. Stay informed about changing tax laws and consult a financial advisor to make informed decisions. Investing wisely and being tax-savvy'll secure your financial future and make the most of your hard-earned money.