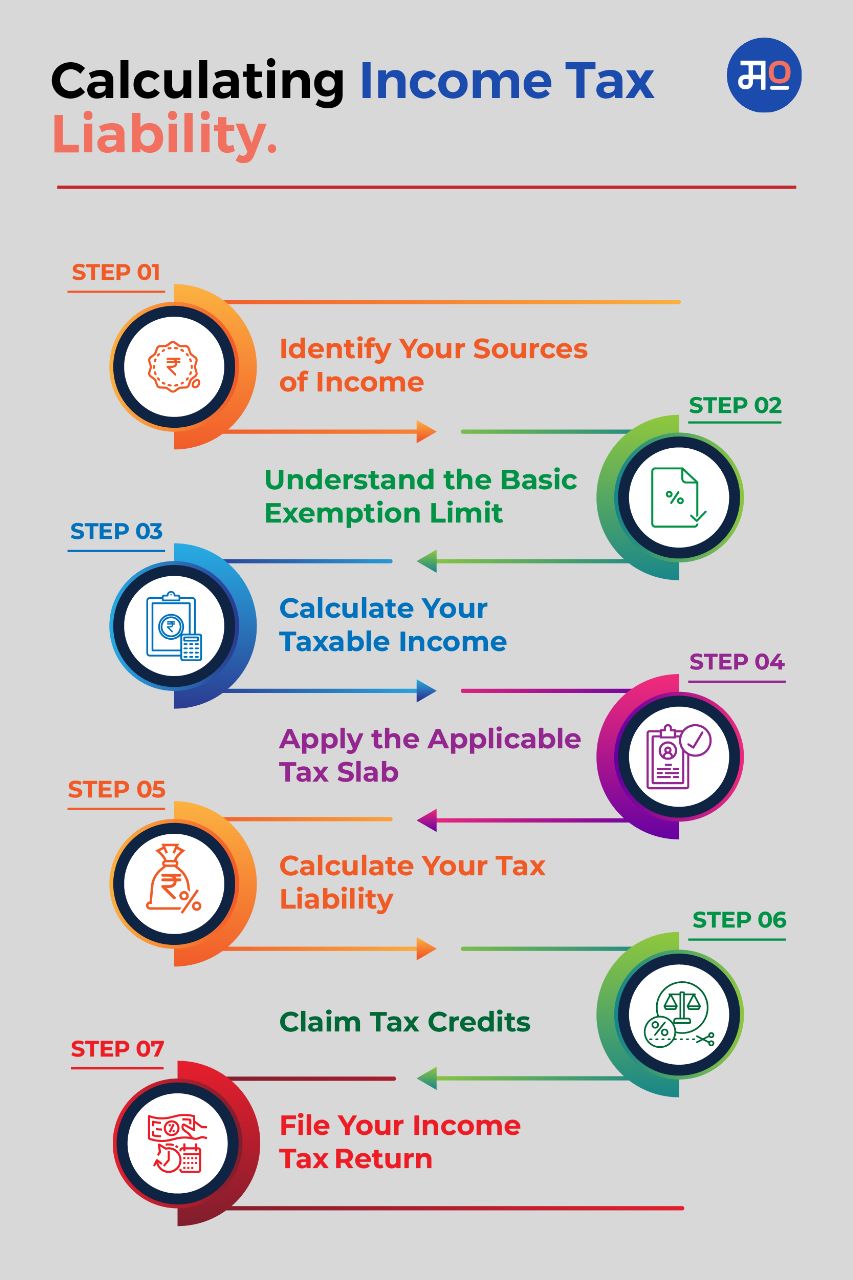

Determining your income tax liability (that is, how much tax you have to pay) involves evaluating your income from various sources and applying the applicable tax rates and deductions. Here's a step-by-step guide to help you navigate this process as a first-time tax filer:

Table of contents [Show]

Identify Your Sources of Income

This includes your salary, part-time job earnings, interest from savings accounts, rental income, or any other sources of income you may have.

Understand the Basic Exemption Limit

For the financial year 2022-23, the basic exemption limit for non-senior citizens (individuals below 60 years of age) is ₹2.5 lakh. If your total income falls below this limit, you are not required to pay taxes.

Calculate Your Taxable Income

To calculate your taxable income, subtract any deductions and exemptions you are eligible for from your total income. Common deductions include those for investments in specified schemes like the Public Provident Fund (PPF), Employee Provident Fund (EPF), and insurance premiums. Ensure you have the necessary documentation to support your deductions.

Apply the Applicable Tax Slab

India follows a progressive tax system, where the tax rates increase as your income rises. Determine the tax slab applicable to your taxable income. The income tax slabs may change each financial year, so it is essential to stay updated on the current rates.

Calculate Your Tax Liability

To determine your tax liability, multiply your taxable income by the applicable tax rate. Remember to consider any surcharges or cess that may be applicable.

Claim Tax Refunds

Employers who are audited (e.g. all companies) are required to deduct taxes at source (TDS). If you have ended up paying more tax than you are due, you are eligible for a refund. Ensure that you include TDS in your calculations to arrive at your final tax liability.

File Your Income Tax Return

Once you have determined your income tax liability, you are ready to file your income tax return. You can do this online using the e-filing portal of the Income Tax Department or seek assistance from a tax professional.

Ensure you stay updated on the current tax laws and seek professional advice if needed to navigate this process smoothly.

Look up more articles here for a smooth first time tax-filing process. All the best!