Creating a monthly budget that involves allocating finances towards various expenses is the key to sustenance in today’s fast-moving world. Here’s a general guide followed by most to kick-start your disciplined budgeting journey, especially if you are a young adult on your first job.

Income Vs. Expenses

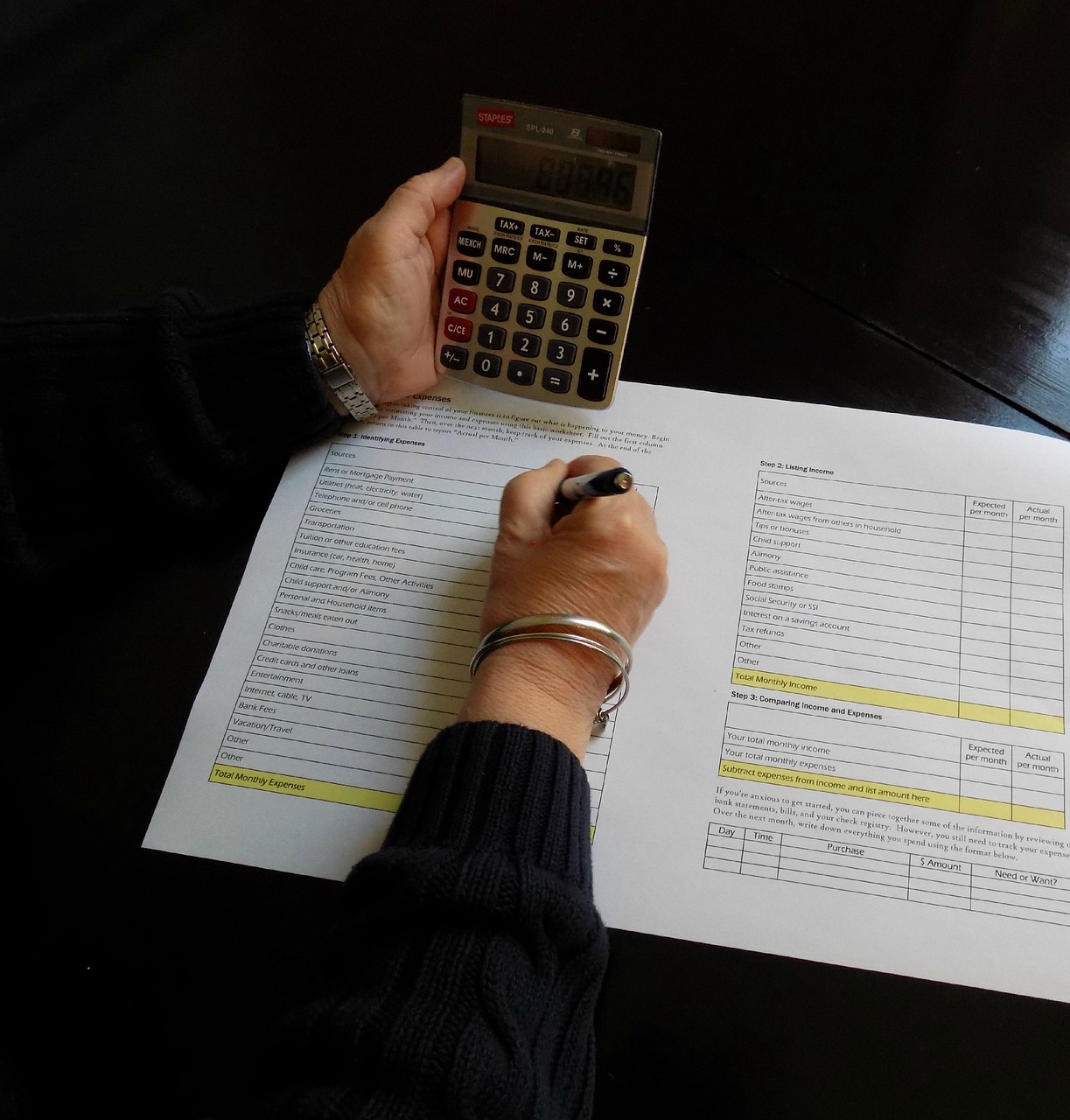

Calculate your total income, including your salary, income from rented property and any other financial support and total costs. You must calculate your recurring fixed monthly expenses such as rent, loan payments, and variable expenses—electricity, ration, and entertainment- and add them to understand and better manage your money.

Amount to allocate to rent and other expenses

There's a golden rule called 50/30/20 to spend your salary. 50% is for necessities, 30% for things that make life more comfortable and 20% for savings or clearing off debts.

Here’s a good practice to allocate your monthly budget on various heads such as rent, commute, entertainment, and so on:

- Rent - 30% max of your take-home salary

- Holidays - 5-10% of your take-home salary

- Transport - 10-15% of your take-home salary

- Utilities - 10-15% of your take-home salary

As you gain experience, you can play around with the allocations towards each category and adjust accordingly as and when required.

Allocate Funds for Investments

Youngsters usually spend whatever they earn and invest whatever is left. This approach is okay for a couple of months since the feeling of self-dependence is something every individual must cherish and enjoy responsibly. But you must understand responsibilities and financial discipline to follow for the rest of your life. Start small by allocating 10% of your total income towards investments. As a few months pass, you must ensure that you increase this amount periodically.

It is best to make it a habit to review your income and expenses bi-annually, at least if not quarterly, to keep yourself in control of your finances. If you are unsure about managing your expenses, you can involve your guardians, friends or siblings who have been managing their income and expenses for a while and learn from their experience.