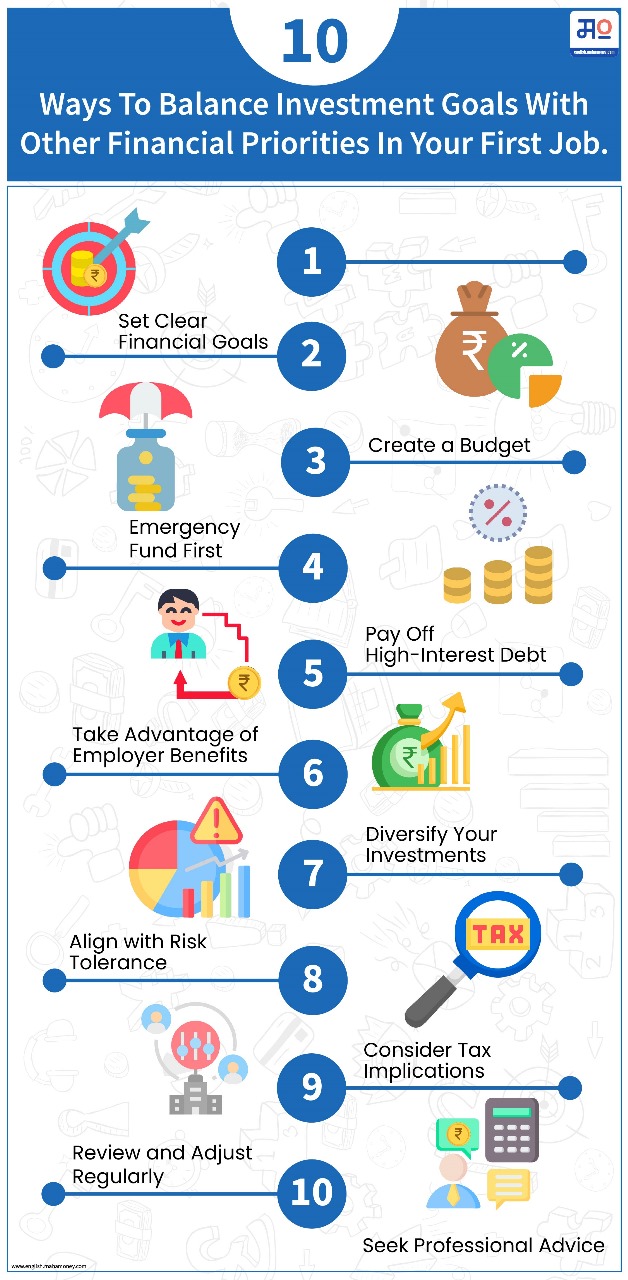

As you embark on your first job, striking a balance between your investment goals and other financial priorities is essential for building a solid financial foundation. Here's how you can achieve this equilibrium:

Table of contents [Show]

1. Set Clear Financial Goals

Define short-term, medium-term, and long-term financial goals. Prioritize necessities like an emergency fund, clearing debts, and ensuring adequate insurance coverage.

2. Create a Budget

Develop a budget that allocates a portion of your income towards both investments and other essential expenses. This will help you manage your money effectively.

3. Emergency Fund First

Create an emergency fund that can cover three to six months of living expenses before investing. This safety net protects you from unexpected financial challenges.

4. Pay Off High-Interest Debt

Prior to making risky investments, concentrate on paying off any high-interest debts you may have, such as credit card bills or personal loans.

5. Take Advantage of Employer Benefits

Explore investment options offered by your employer, such as EPF and NPS, which often come with employer contributions.

6. Diversify Your Investments

Spread your investments across various asset classes and sectors to manage risk effectively and optimize potential returns.

7. Align with Risk Tolerance

Understand your risk tolerance and tailor your investment choices accordingly. Conservative investors may opt for fixed deposits and debt instruments, while those with higher risk tolerance may explore equities.

8. Consider Tax Implications

Factor in tax-saving investment options like ELSS and PPF to optimize tax benefits while aligning with your financial goals.

9. Review and Adjust Regularly

Reevaluate your financial goals periodically and adjust your investment strategy as life circumstances change.

10. Seek Professional Advice

If you need help managing investments or balancing priorities, consult a certified financial advisor who can guide you through personalized strategies.

Balancing investment goals with other financial priorities is crucial to your first job. Prioritize emergency funds, debt clearance, and essential expenses. Regularly review your financial plan and seek professional advice when needed. By striking this balance, you'll pave the way for a financially secure and prosperous future while achieving your diverse financial aspirations.