Are you a taxpayer looking to ease the burden of your taxes or perhaps aiming for a nil tax liability? Good news! There's an e-procedure that can simplify the process for you. Let's dive into the basics.

What is E-Procedure for Nil or Lower Tax?

The e-procedure is a digital way of dealing with your income tax matters, especially if you are expecting your income to fall within the nil or lower tax brackets. It streamlines the process, making it more accessible and convenient for taxpayers.

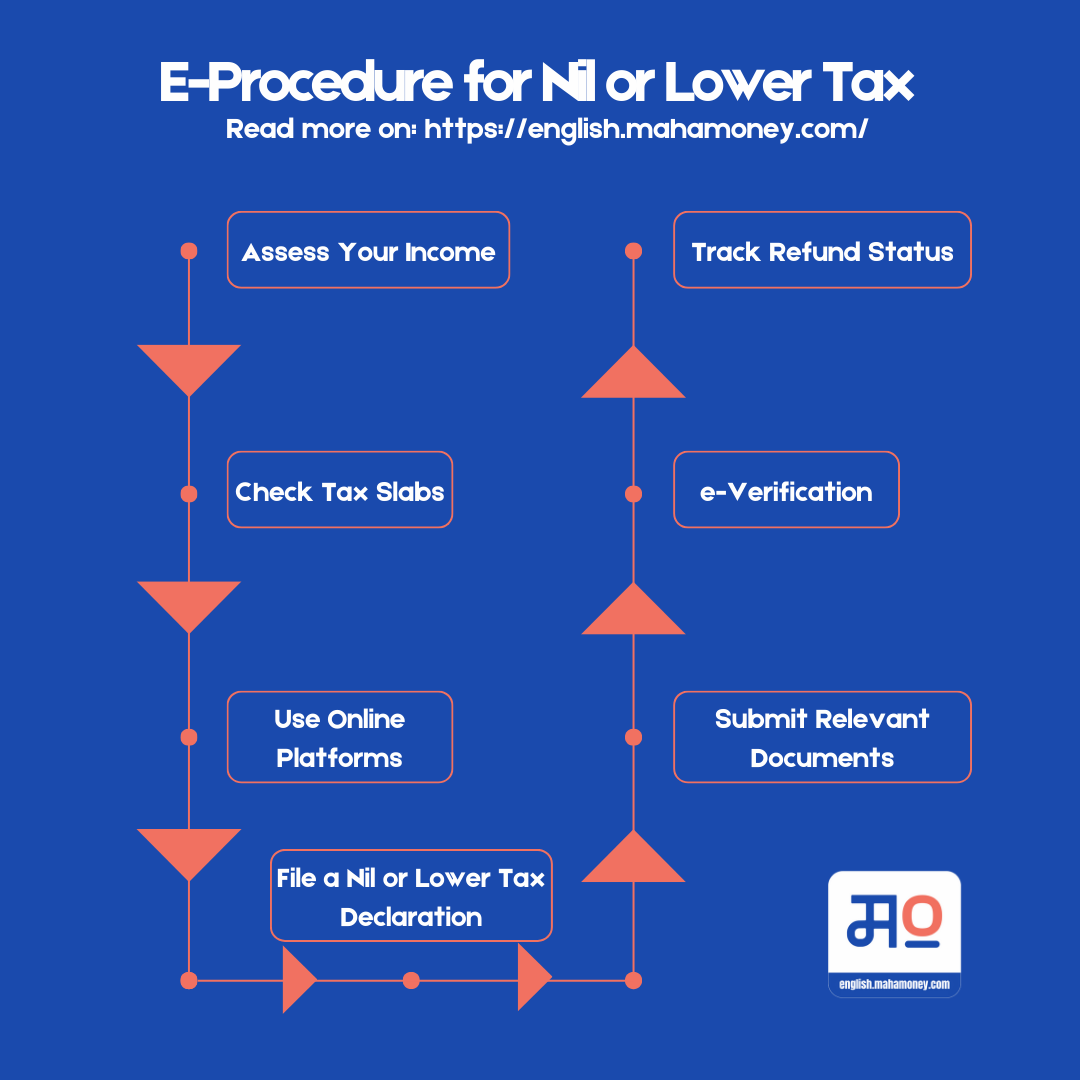

Step-by-Step Guide:

1. Assess Your Income:

Start by evaluating your total income for the year. This includes your salary, any income from business or profession, house property, capital gains, and other sources.

2. Check Tax Slabs:

Understand the income tax slabs and rates applicable for the current financial year. This will help you determine if your income falls within the nil or lower tax brackets.

3. Use Online Platforms:

Many government portals and income tax filing websites offer online tools to calculate your tax liability. Utilize these tools to get an estimate of your tax obligation.

4. File a Nil or Lower Tax Declaration:

If your calculated tax liability is nil or falls within the lower brackets, you can declare this while filing your income tax return. There's usually a specific section where you can mention this declaration.

5. Submit Relevant Documents:

Make sure to submit any required documents or proofs along with your tax return to support your declaration. This might include investment proofs, deductions, and other relevant documents.

6. e-Verification:

After filing your return, the next step is e-verifying it. This can be done through various methods like Aadhar OTP, net banking, or a physical signature verification process.

7. Track Refund Status:

If you are eligible for a refund, you can track its status through the income tax department's online portal. This keeps you informed about the processing of your return.

Benefits of E-Procedure

| Convenience | The entire process is digital, allowing you to file your return from the comfort of your home. |

| Time-Saving | It saves time compared to traditional filing methods. |

| Accuracy | Online tools help in accurate calculation, reducing the chances of errors. |

The e-procedure for nil or lower tax is a taxpayer-friendly initiative designed to simplify the process of filing returns, especially for those with minimal or no tax liability. By understanding the steps involved and leveraging online tools, you can navigate this process with ease. So, go ahead and embrace the digital convenience in managing your taxes!