Table of contents [Show]

Option 1: Official Portal

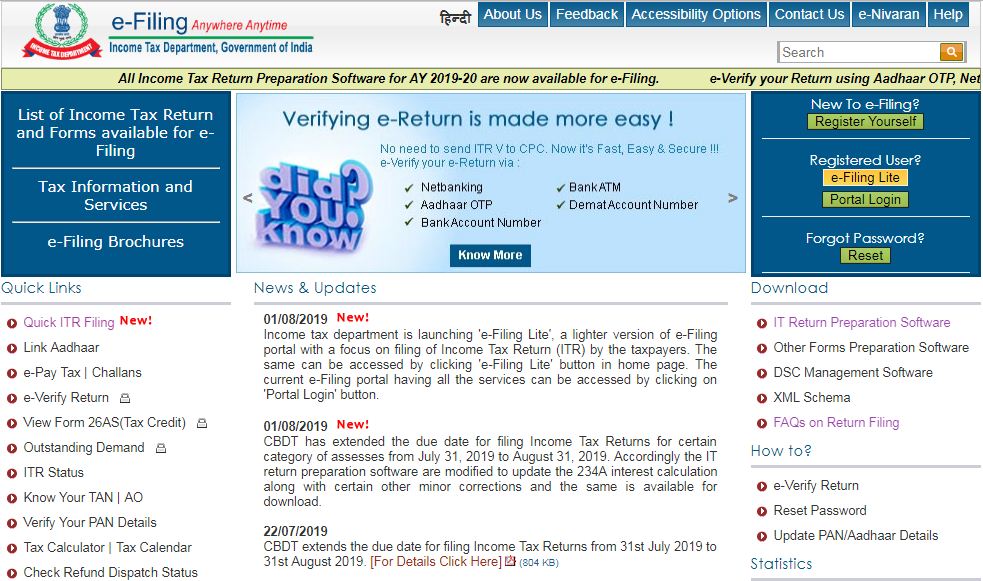

The Income Tax Department's official e-Filing portal (www.incometaxindiaefiling.gov.in) is the most widely used platform for filing taxes in India. It provides a user-friendly interface, secure data transmission, and a comprehensive set of features. You can register yourself on the portal, file your tax return using the relevant ITR form, and make online tax payments if required. Additionally, the portal offers various services, such as tracking tax refunds and accessing tax-related documents.

In addition to the official portal, there are authorized online tax filing platforms that provide user-friendly interfaces and additional services. These platforms are approved by the Income Tax Department, ensuring compliance and security. Examples include ClearTax, Tax2Win, and H&R Block. These platforms offer step-by-step guidance, automated calculations, and document storage facilities to simplify the tax filing process, making them ideal choices for young individuals seeking convenience and assistance.

Option 3: Online Tax Preparation Software

Another option is using online tax preparation software like TurboTax or TaxAct. These platforms provide comprehensive tools to prepare and file your taxes accurately. They offer intuitive interfaces, interview-style questionnaires, and automated calculations. While these software options are primarily popular in countries like the United States, some platforms cater to Indian taxpayers as well. Ensure that the software you choose is specifically designed for Indian tax regulations.

Considerations for Choosing the Right Portal

When selecting an online portal to file your taxes, consider factors such as user-friendliness, data security, customer support, and additional features offered. Compare the available options based on their reputation, user reviews, and pricing models, if applicable. It is also advisable to choose a platform that provides regular updates on tax laws and provisions to stay compliant with the latest regulations.