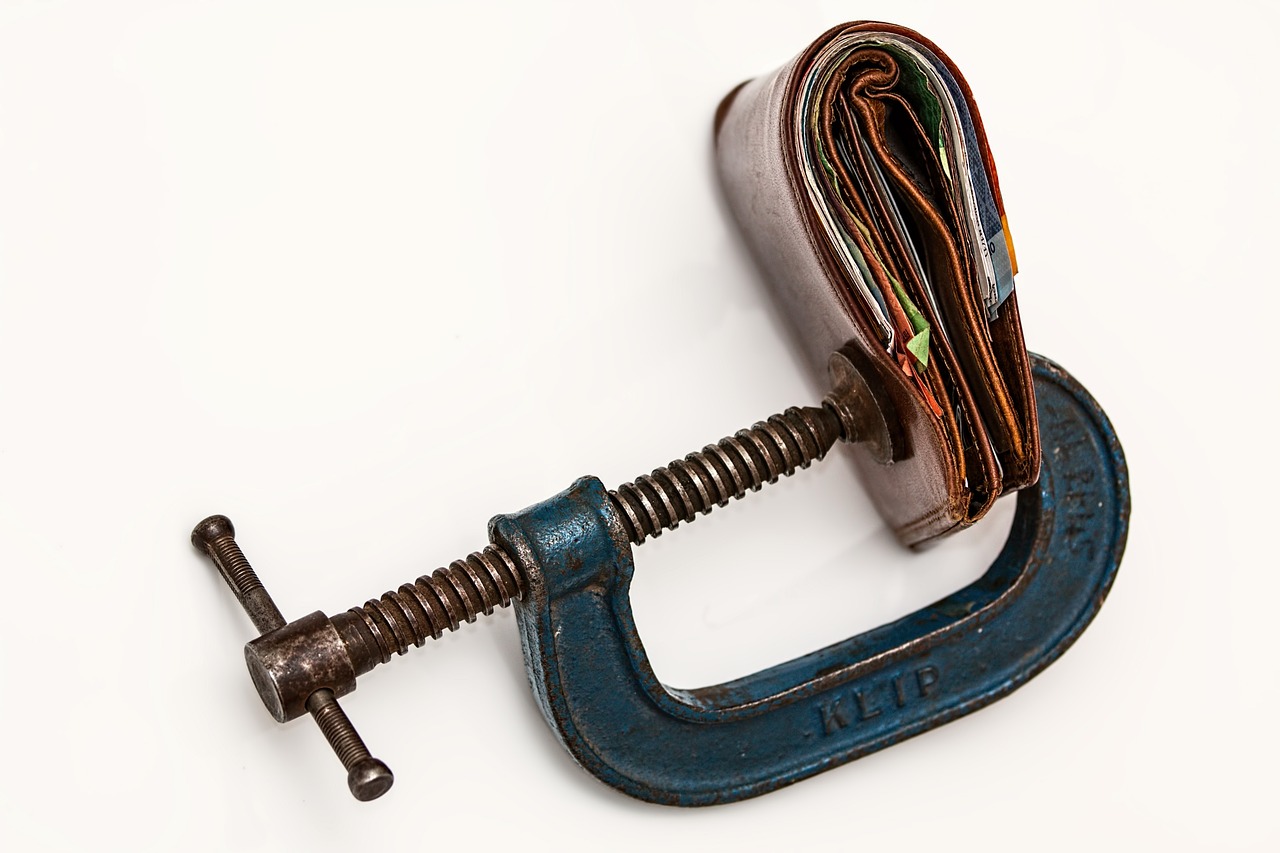

Inflation is an important concept to understand because it affects the purchasing power of your money over time. First, let’s understand what’s inflation - it is a rise in prices, which can be translated as the decline of purchasing power over time. Matlab, jaise jaise mehengayi badti hai, waise waise hum kam cheeze kharidh paate hai.

Here's how it can impact your home budget:

Table of contents [Show]

Rising prices

Inflation generally leads to an increase in the prices of goods and services. This means that over time, the same amount of money will buy you fewer things.

Adjusting budgets

It's important to periodically review and update your budget to account for increasing costs.

Savings erosion

Inflation can badly affect the purchasing power of your savings. If the interest earned on your savings doesn't keep up with inflation, your money may not grow enough to maintain its value over time. Take note of this factor.

Long-term financial goals

Inflation impacts long-term financial goals, such as saving for a house, car, or retirement. It's essential to account for inflation when setting these goals and determining the amount of money you need to save. Inflation reduces the future value of money, so it's important to save and invest only in those assets that have the potential to outpace inflation over time.

Salary and income considerations

Inflation can affect your income as well. If your salary doesn't keep up with inflation, your purchasing power may decrease. It's important to be aware of inflation when negotiating salaries or considering career advancements.

Interest rates

Inflation also influences interest rates set by banks and lenders. When inflation rises, central banks may increase interest rates to control it. This can affect the cost of borrowing money, such as mortgages or student loans. It's important to consider the impact of inflation on interest rates when planning for major purchases or taking on debt.

Budgeting for unexpected expenses

Inflation can make it harder to budget for unexpected expenses. As prices rise, unexpected costs can put a strain on your budget. It's wise to build an emergency fund that can act as a safety net for sudden situations, helping you avoid going into debt when faced with unexpected expenses.

Understanding the impact of inflation on home budgeting empowers you to make informed financial decisions. Stay vigilant, regularly review your budget, consider investment options, and focus on building your financial resilience.