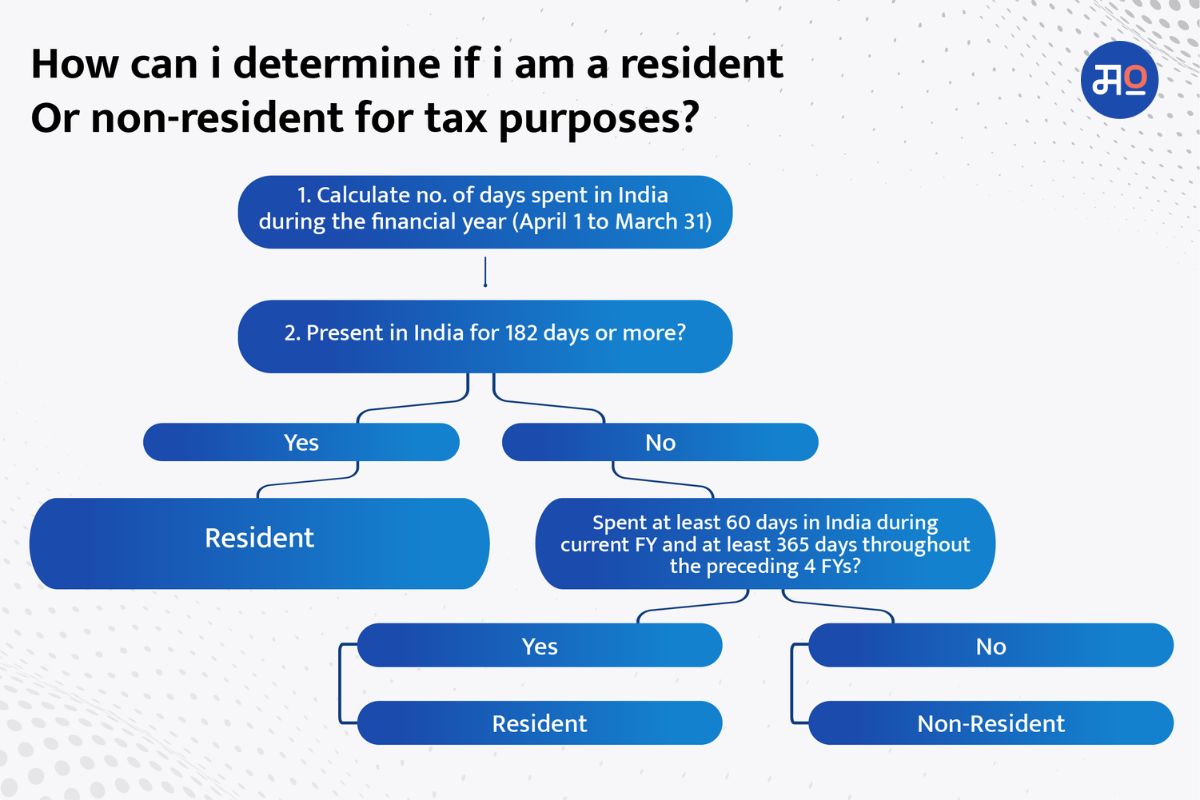

To determine your tax liability on income from abroad, it is essential to determine your residential status. If you stay in India for 182 days or more during the financial year, or 60 days or more during the financial year and 365 days or more during the preceding four financial years, you are considered a resident for tax purposes.

Tax Liability for Residents

If you qualify as a resident for tax purposes, you are required to pay taxes in India on your global income, including income earned from abroad. This includes salary, rental income, capital gains, business income, and any other income received from foreign sources. Such income should be disclosed in your tax return and taxed at the applicable rates.

Double Taxation Relief

To avoid double taxation, where income is taxed both in India and the country of its source, India has entered into Double Taxation Avoidance Agreements (DTAAs) with several countries. These agreements provide relief by allowing taxpayers to claim a tax credit or exemption in India for taxes paid abroad. It is important to refer to the specific provisions of the DTAA applicable to your situation to determine the relief available.

Foreign Asset and Income Reporting

Apart from tax liability, it is important to note that Indian residents are required to report their foreign assets and income under the Foreign Asset and Income Reporting provisions. This includes bank accounts, immovable property, financial interests, and other assets held abroad. Failing to report foreign assets and income can result in penalties and legal consequences.

Taxation of income from abroad can be complex, especially when considering international tax laws and DTAAs. It is advisable to seek professional assistance or consult a tax advisor who can provide guidance based on your specific circumstances. They can help you navigate the complexities, ensure compliance, and optimize your tax liability.

Look up more articles here for a smooth first time tax-filing process. All the best!