Section 24(b) of the Income Tax Act allows for deductions on the interest paid on a home loan. As a first-time tax filer, you can claim this deduction if you have taken a home loan for the purchase, construction, or renovation of a residential property. The deduction limit is subject to certain conditions:

- Self-occupied property: If you are living in the property for which the home loan is taken, you can claim a maximum deduction of up to Rs. 2,00,000 per financial year.

- Let-out property: If you have let out the property on rent, there is no maximum limit for claiming the deduction. You can claim the actual interest paid as a deduction from the rental income.

- Under construction property: For under-construction properties, the deduction can be claimed in equal installments over a period of five years starting from the year of possession.

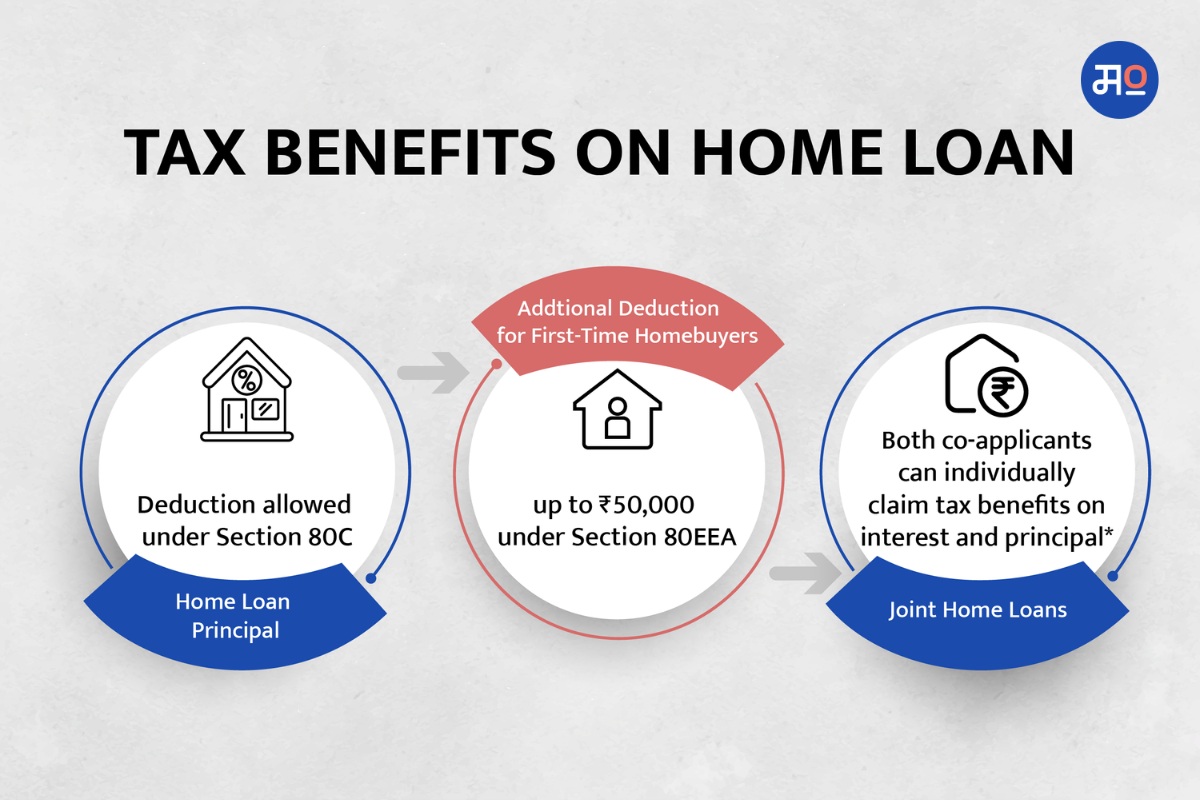

Additional Deduction under Section 80EEA

As a first-time homebuyer, you may be eligible for an additional deduction of up to Rs. 1,50,000 under Section 80EEA. This deduction is over and above the deduction available under Section 24(b) and is subject to certain conditions, including:

- The loan should be sanctioned by a financial institution between specific financial years.

- The property's stamp duty value should not be higher than Rs. 45 lakhs.

- The taxpayer should not own any residential property on the date of the loan sanction.

Supporting Documents

To claim deductions for home loan interest, you need to gather and maintain the necessary supporting documents, including loan statements, interest certificates, and completion certificates (for under-construction properties). These documents serve as evidence of the interest paid and help support your claim during the tax filing process.

As a first-time tax filer in India, You may be able to lower your taxable income by deducting the interest you spent on a home loan. However it is advisable to consult a tax professional or refer to the Income Tax Department's guidelines for specific eligibility criteria and documentation requirements based on your circumstances.

Look up more articles here for a smooth first time tax-filing process. All the best!