The National Pension Scheme is a government-sponsored retirement savings scheme aimed at providing financial security during your post-retirement years. It allows individuals to contribute regularly towards their retirement savings and invests those contributions in a mix of government securities, equity and corporate bonds.

Tax Benefits for NPS Contributions

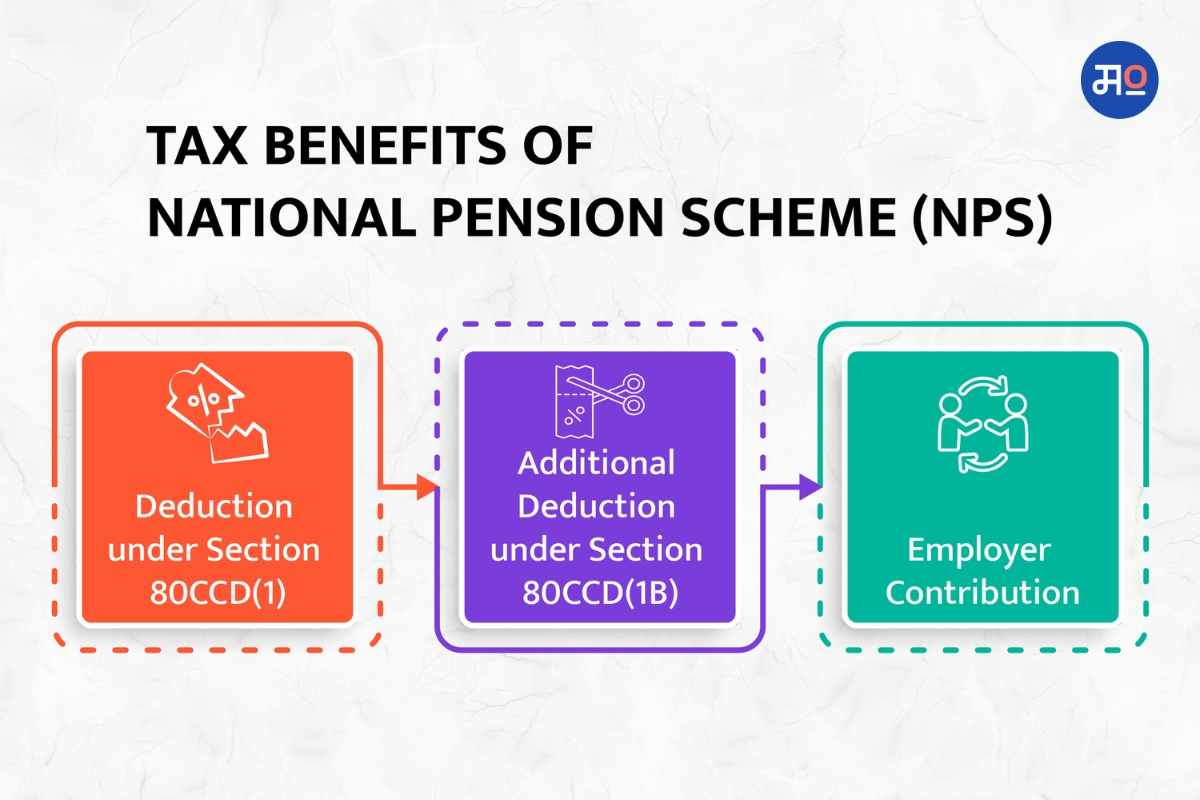

As a first-time filer contributing to the NPS, you can enjoy tax benefits under three different sections of the Income Tax Act:

- Deduction under Section 80CCD(1): You are eligible to claim a deduction of up to 10% of your salary (for salaried individuals) or gross income (for self-employed individuals) contributed to the NPS. The maximum deduction allowed is Rs. 1.5 lakh per financial year, which is inclusive of other eligible deductions under Section 80C.

- Additional Deduction under Section 80CCD(1B): In addition to the deduction under Section 80CCD(1), first-time filers contributing to the NPS can claim an additional deduction of up to Rs. 50,000 under Section 80CCD(1B). This deduction is supposed to be over and above the limit of Rs. 1.5 lakh allowed under Section 80C.

- Employer Contribution: If your employer contributes to your NPS account, it is eligible for a deduction under Section 80CCD(2). The deduction is limited to 10% of your salary (basic salary + dearness allowance) and does not have any monetary limit.

Tax Treatment of NPS Withdrawals

While contributions to the NPS enjoy tax benefits, it's important to note that the withdrawals from the NPS are subject to taxation. At the time of retirement, a portion of the accumulated collection can be withdrawn as a lump sum, and the remaining must be used to purchase an annuity. The lump sum withdrawal is subject to taxation based on the prevailing tax rates.

Contributing to the National Pension Scheme (NPS)not only helps you secure your future but also offers tax benefits. By utilizing the deductions available under Section 80CCD(1) and 80CCD(1B), you can reduce your taxable income and optimize your tax liabilities. Make sure to keep track of your NPS contributions and consult a tax professional for personalized advice based on your financial goals and tax planning needs.

Look up more articles here for a smooth first time tax-filing process. All the best!