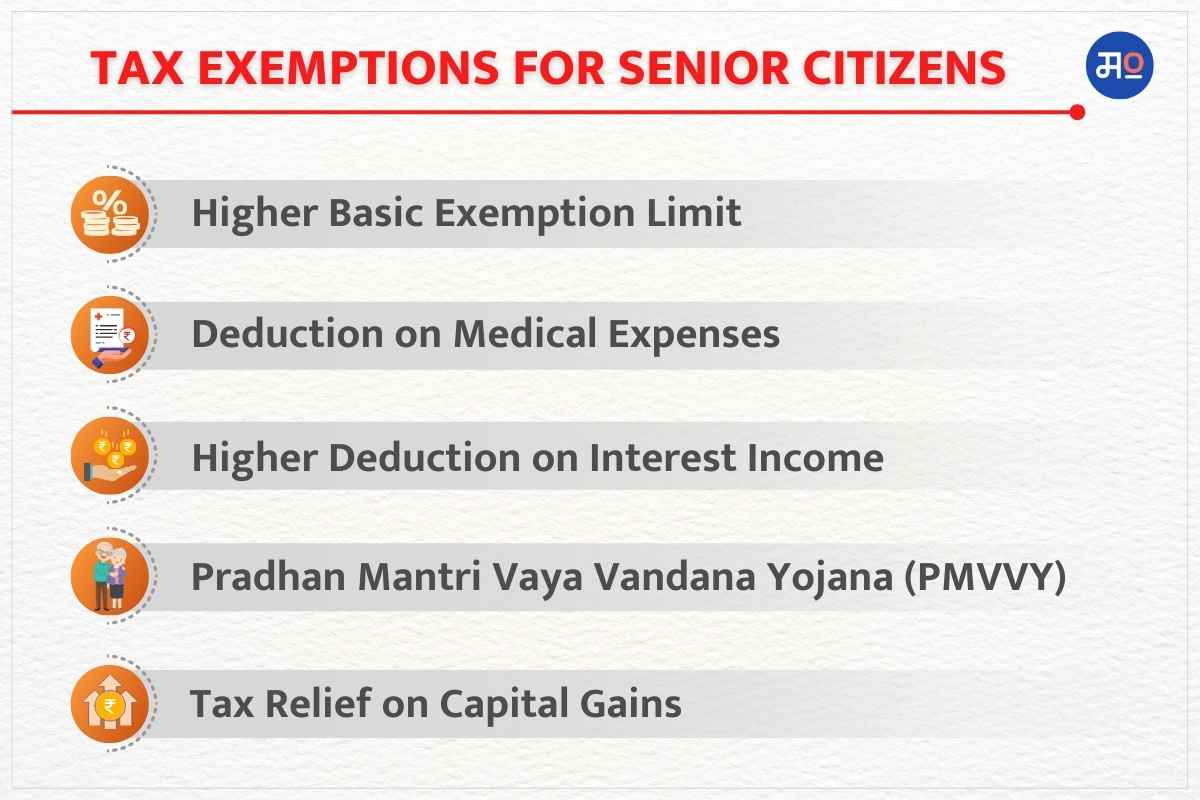

Yes, senior citizens enjoy specific tax exemptions and benefits. Here are the financial advantages they can avail.

Table of contents [Show]

Higher Basic Exemption Limit

Senior citizens, aged 60 years or above, enjoy a higher basic exemption limit comparatively. For them the basic exemption limit is ₹3 lakh which means that their income up to ₹3 lakh is exempted from income tax.

Deduction on Medical Expenses

Under Section 80D they can avail a deduction of up to ₹50,000 for medical insurance premiums paid for themselves or their dependents. Plus, they can even claim a deduction of up to ₹50,000 for medical expenses incurred on treatments or preventive health check-ups.

Higher Deduction on Interest Income

Under Section 80TTB, they can claim a deduction of up to ₹50,000 on interest income earned from deposits in savings accounts, fixed deposits, and recurring deposits. This deduction is exclusive to senior citizens and is in addition to the existing deduction available to all taxpayers under Section 80TTA.

Pradhan Mantri Vaya Vandana Yojana (PMVVY)

The Pradhan Mantri Vaya Vandana Yojana is a government-backed pension scheme exclusively available for senior citizens. Under this scheme, senior citizens can invest a lump sum amount and receive a guaranteed pension at a specified interest rate. The pension received is exempt from income tax.

Tax Relief on Capital Gains

Senior citizens can avail tax relief on capital gains from the sale of specified assets, such as property or shares, by investing in specified bonds. Under Section 54EC, if the proceeds from the sale of assets are invested in eligible bonds within the specified time frame, the capital gains are exempt from tax.

Understanding these exemptions can help senior citizens reduce their tax liability and manage their finances effectively. It is advisable to consult with a tax professional to fully comprehend and make the most of these exemptions.

Look up more articles here for a smooth first time tax-filing process. All the best!