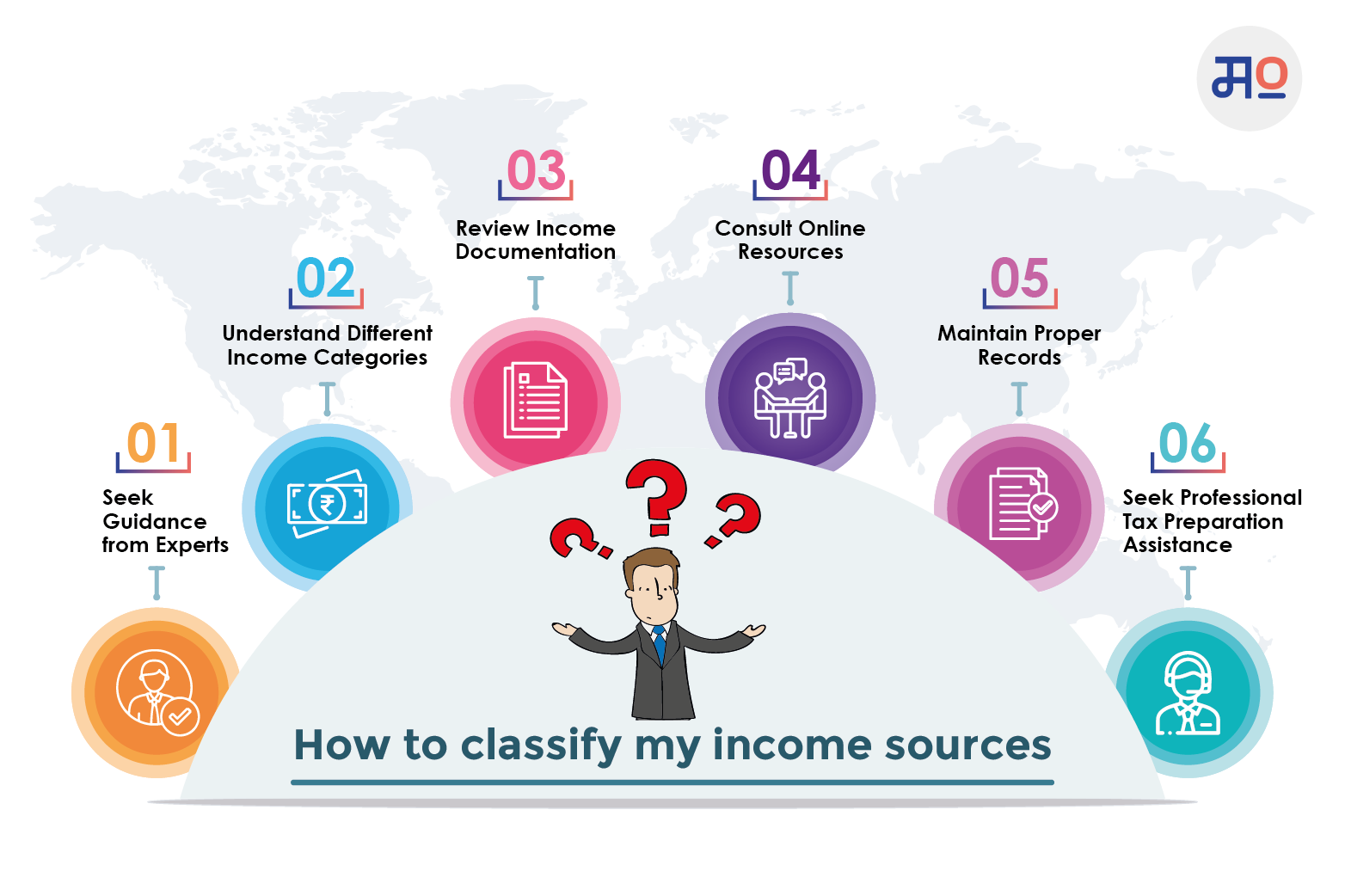

If you are unsure about how to classify your income sources for tax filing, follow these steps to navigate the process smoothly:

Table of contents [Show]

Seek Guidance from Experts

When in doubt, it's always helpful to seek guidance from tax professionals or chartered accountants. They have expertise in tax matters and can provide clarity on how to classify different income sources based on their nature and specific tax regulations.

Understand Different Income Categories

To classify your income sources correctly, it's essential to understand the different income categories recognized by the tax authorities in India. Common income categories include:

- Salary income: Income earned from employment.

- Business or professional income: Income generated from self-employment, freelancing, or running a business.

- Capital gains: Profits earned from the selling of assets like stocks, property, or mutual funds.

- Rental income: Income received from renting out property.

- Other sources: Income from interest, dividends, royalties, or any other miscellaneous sources.

Review Income Documentation

Carefully review the documentation such as salary slips, bank statements, rent agreements, investment statements, and any other relevant records. This will help you identify the nature of your income and determine the appropriate category for each source.

Consult Online Resources

The Income Tax Department's official website and other reliable online resources provide detailed information on how to classify various types of income sources.

Maintain Proper Records

Keep accurate and organized records of your income sources, expenses, and supporting documents. This will not only help you classify your income correctly but also ensure smooth tax filing and serve as evidence in case of any future queries from the tax authorities.

Seek Professional Tax Preparation Assistance

Consider using professional tax preparation software or engaging a tax professional to assist you in accurately classifying your income sources. These tools and experts can help simplify the process, minimize errors, and ensure compliance with tax regulations.

By taking these steps, you can confidently classify your income sources and fulfill your tax obligations accurately.

Look up more articles here for a smooth first time tax-filing process. All the best!