After filing your tax return in India, it is important to stay updated on its status and track any refunds that may be due to you. Here’s a step-by-step guide on how to check the status of a filed tax return and track refunds efficiently.

Table of contents [Show]

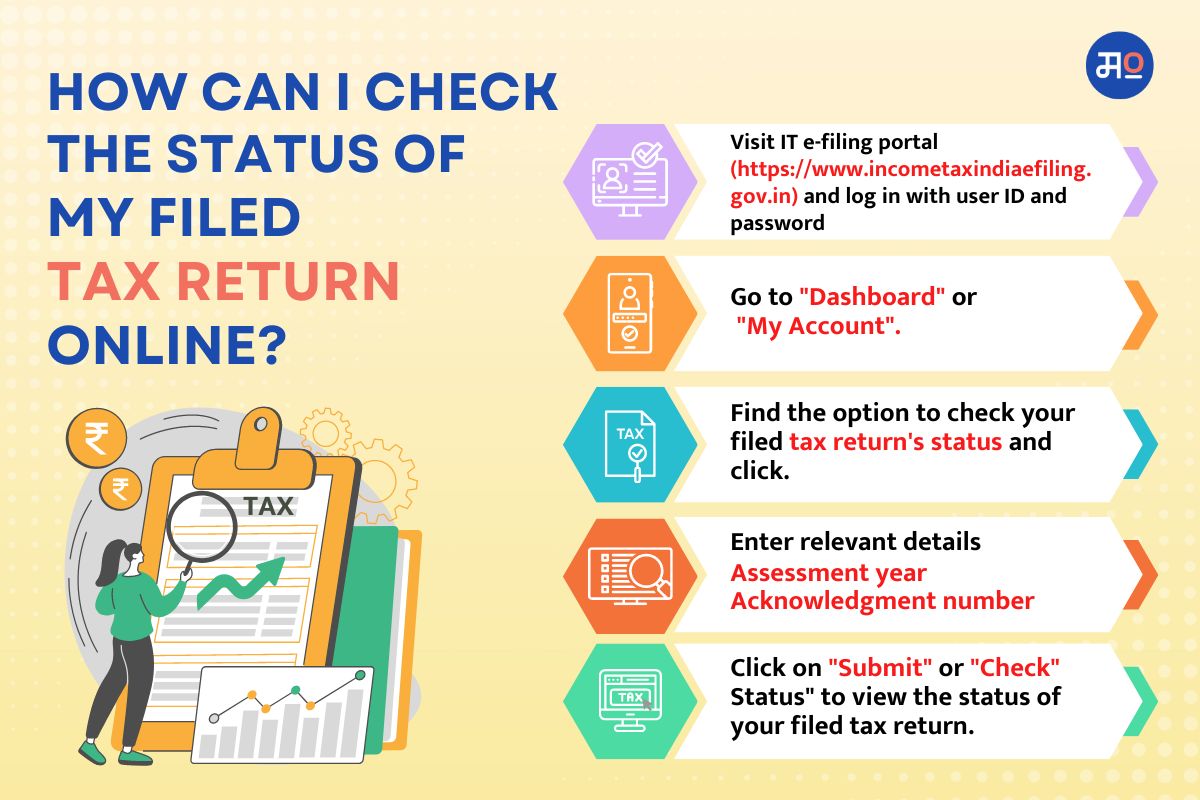

Step 1: Log in to the Income Tax e-Filing Portal

Visit the official Income Tax e-Filing portal (www.incometaxindiaefiling.gov.in) and log in using your credentials. If you do not have an account, create one by registering as a new user.

Step 2: Access the "My Account" Section

Once logged in, navigate to the "My Account" section or a similar option on the portal. This section provides various options and features related to your tax filing, including tracking the status of your tax return and refunds.

Step 3: Check Tax Return Status

In the "My Account" section, select the option to check the status of your tax return. Enter the relevant assessment year and details of the tax return form. The website/portal will display the current status of your filed tax return, whether it is processed, under assessment, or any other applicable status.

Step 4: Track Refunds

To track any refunds due to you, follow these steps:

- In the "My Account" section, select the option to track refunds. Enter the relevant assessment year and your Permanent Account Number (PAN).

- The portal will display the status of your refund, whether it is processed, pending, or any other relevant status. It will also provide the refund amount, if applicable.

- If your refund is processed, you can view the mode of payment (such as direct deposit to bank account) and the refund reference number.

- If your refund is pending or not yet processed, you can regularly check the portal for updates or contact the Income Tax Department's helpline for further assistance.

By following the procedures mentioned above, you can keep yourself updated on the status of your tax return and track any refunds efficiently. Regular monitoring ensures that you receive the refunds timely and allows you to manage your finances effectively.

Look up more articles here for a smooth first time tax-filing process. All the best!