The Employee Provident Fund is a retirement savings scheme established by the government of India. It is a mandatory contribution made by both employees and employers towards an employee's retirement fund. The Employees' Provident Fund Organization (EPFO) manages EPFs.

Tax Benefits of EPF Contributions

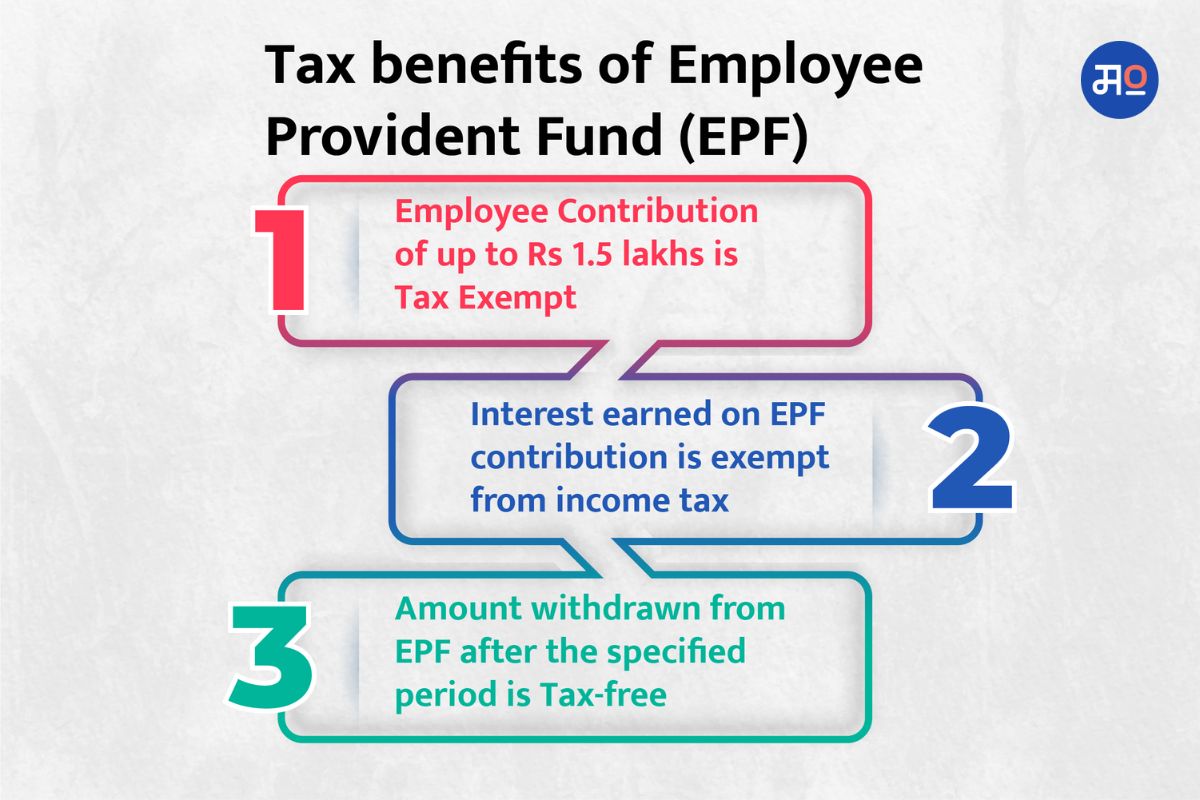

Contributions made to the EPF offer tax benefits under the Income Tax Act, making it a valuable investment avenue for first-time tax filers. The tax benefits are categorized as:

- Tax Exemption on Employee Contributions: Section 80C of the Income Tax Act allows for a deduction for employee contributions made to the EPF. The maximum deductible amount is currently capped at Rs. 1.5 lakh per year.

- Tax-Free Interest: The interest earned on EPF contributions is exempt from income tax. The EPF offers a competitive interest rate, which is determined by the government annually. The interest earned on EPF contributions gets added to your account and grows tax-free over time.

- Tax-Free Withdrawals: Upon retirement or the completion of five years of continuous service, you become eligible to withdraw the EPF balance. The amount withdrawn from the EPF after the specified period is tax-free, ensuring that you can enjoy the accumulated savings without any tax implications.

Long-Term Retirement Planning

The tax benefits associated with EPF contributions, along with the power of compounding, can significantly enhance your retirement savings over time. It is a wise financial decision to start contributing to the EPF early in your career to maximize the benefits of long-term wealth creation.

Other Considerations

It's important to note that EPF contributions are mandatory for employees falling under the EPF Act. However, if you are working in an organization not covered by the EPF Act or are self-employed, you can consider alternative retirement savings options such as the National

Pension Scheme (NPS) or Voluntary Provident Fund (VPF). These schemes also offer tax benefits and can serve as effective retirement planning tools.

Contributing to the Employee Provident Fund (EPF) not only helps you build a retirement corpus but also offers significant tax benefits as a first-time tax filer in India. Start early and take advantage of the EPF's tax benefits to secure your financial future.

Look up more articles here for a smooth first time tax-filing process. All the best!