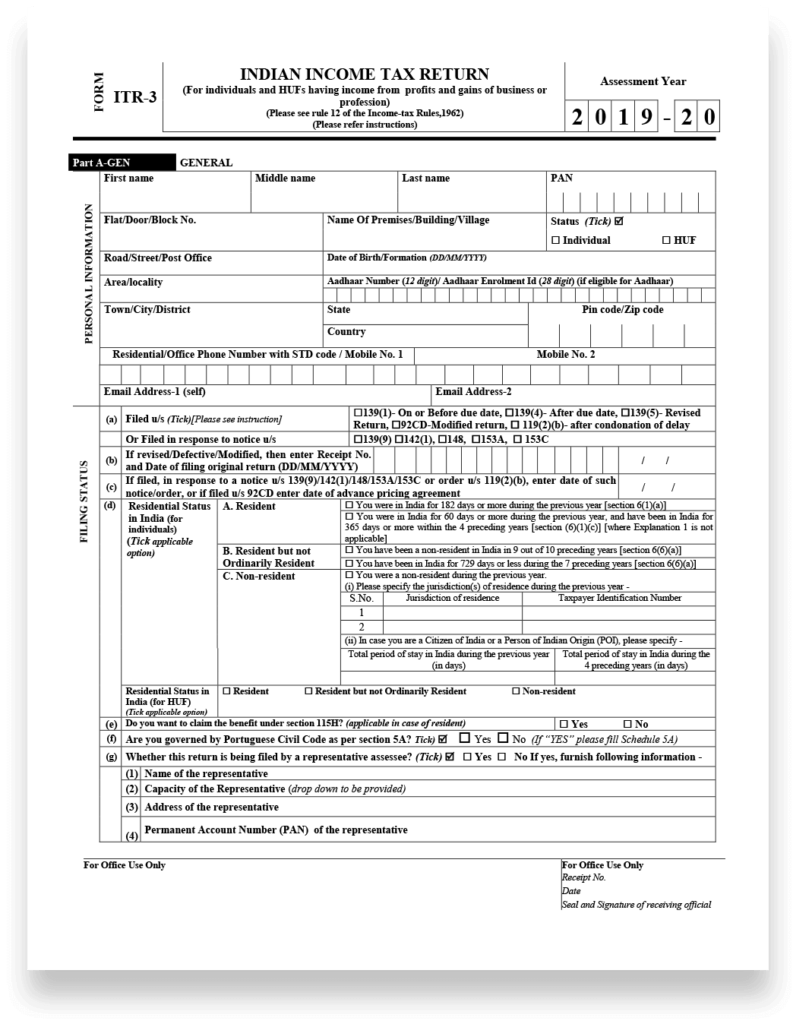

The ITR-3 form is specifically designed for individuals and Hindu Undivided Families (HUFs) who have income from a proprietary business or are engaged in a profession. It is applicable to business owners, self-employed professionals, and partnerships (except those who are subject to audit under any other law). Here's why the ITR-3 form is suitable for business owners and self-employed individuals.

Table of contents [Show]

Business Income

If you are running a proprietary business or are self-employed, the ITR-3 form allows you to report your business income accurately. This includes income from sales, services, or any other commercial activities you are involved in.

Partnership Income

If you are a partner in a partnership firm, the ITR-3 form enables you to report your share of income from the partnership. It provides a structured format to report partnership income and deductions.

Profession Income

If you are engaged in a profession such as law, medicine, architecture, or any other professional practice, the ITR-3 form is suitable for reporting your professional income. It allows you to provide details of your professional receipts and expenses.

Auditing Requirement

The ITR-3 form is applicable to business owners and self-employed individuals who are not required to undergo statutory audit under any other law. If your business or professional turnover exceeds the specified limits (currently Rs. 2 crores for businesses and Rs. 50 lakhs for professionals), you may need to undergo a tax audit.

While this article provides an overview of the ITR-3 form, it is advisable to consult a tax professional or refer to the official website of the Income Tax Department of India for the most up-to-date information on ITR forms and filing requirements.

Look up more articles here for a smooth first time tax-filing process. All the best!